Navigating the Agricultural Landscape: Evolution & Impact of Crop Insurance Market

Last updated on June 24th, 2024 at 11:02 am

WHAT IS CROP INSURANCE?

Crop insurance is a type of insurance designed to protect farmers and agricultural producers against financial losses resulting from natural disasters, adverse weather conditions, or other unavoidable circumstances. These circumstances can negatively impact their crop yields or revenue. The crop insurance provides a safety net for farmers by compensating them for losses incurred due to events, such as droughts, floods, hailstorms, pests, diseases, or excessive rainfall.

WHAT ARE THE TYPES OF CROP INSURANCE?

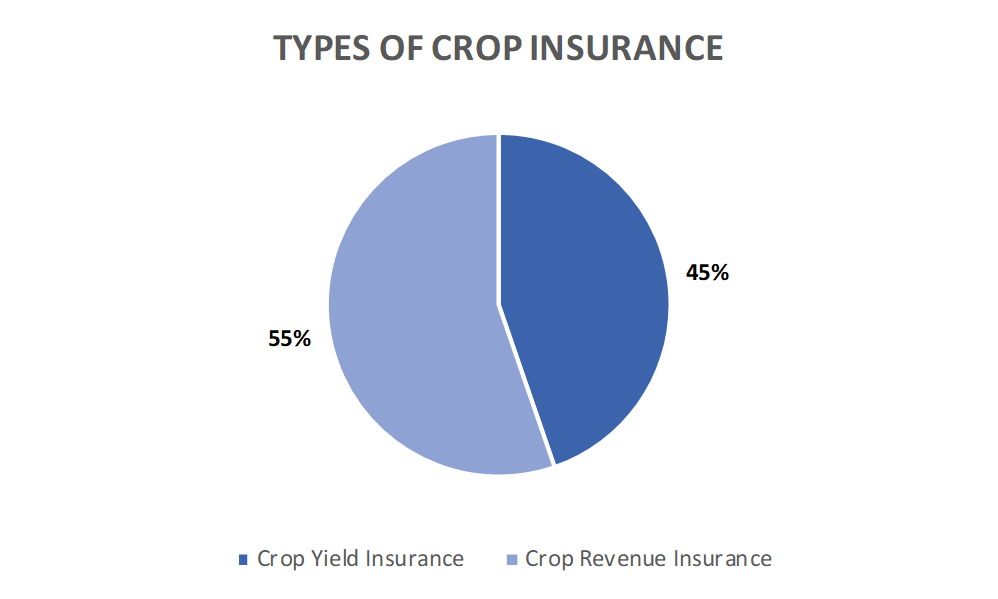

According to the report published by Next Move Strategy Consulting on the crop insurance market, there are two main types of crop insurance: Crop yield insurance and crop revenue insurance.

Crop Yield Insurance:

Crop yield insurance, which holds 45% of the market share within the crop insurance market, is designed to compensate farmers for losses in crop yield due to various perils, such as adverse weather conditions, pests, diseases, or other unavoidable circumstances.

This type of insurance typically provides coverage based on the actual yield of the insured crop. It indemnifies farmers for the difference between their actual yield and a guaranteed yield level, often referred to as the “trigger yield.”

Source: Next Move Strategy Consulting

Crop Revenue Insurance:

Crop revenue insurance, accounting for 55% of the market share within the crop insurance market, protects farmers against fluctuations in crop prices and yield losses.

Unlike crop yield insurance, which focuses solely on the quantity of crop produced, crop revenue insurance provides coverage based on the revenue generated from the sale of the insured crop.

It considers the crop yield and the market price at the time of harvest. This consideration ensures that farmers receive compensation for any shortfall in revenue caused by factors, such as low yields or price volatility.

Crop yield insurance and crop revenue insurance play crucial roles in safeguarding farmers’ livelihoods and ensuring the stability of the agricultural industry by mitigating financial risks associated with crop production. These insurance products provide farmers with much-needed peace of mind, enabling them to invest in their operations with confidence and maintain a sustainable agricultural business despite unpredictable external factors.

WHAT ARE THE TECHNOLOGICAL ADVANCEMENTS IN FARMING INSURANCE?

Technological advancements in crop insurance have been transformative, offering accurate risk assessment, rapid claims processing, and improved overall efficiency. Here are some key technological advancements in crop insurance.

1. Crop Insurance Revolutionized: Advancements in Technology

There has been a notable emphasis on incorporating advanced technology into crop insurance, such as remote sensing, satellite imagery, drones, and weather data. These technological advancements offer precise evaluations of crop conditions, estimation of yields, and assessment of damages. Consequently, this integration helps curb fraudulent claims and simplify the claims process within the crop insurance sector.

HDFC ERGO introduced a pioneering farm yield insurance policy, leveraging technology to support farmers. This innovative insurance solution utilizes satellite-based indices to offer localized coverage at the farm level. Using satellite data ensures comprehensive protection throughout the crop cycle, from planting to harvesting. This product caters to farmers engaged in corporate or farm input company (FIC) contracts and extends coverage to various crops, including food, oilseed, commercial, or horticulture crops.

2. Elevating Crop Insurance: The Power of Parametric Insurance:

Parametric insurance has become increasingly popular as it disburses funds according to predetermined triggers, such as weather patterns or yield indicators. This type of insurance can offer faster payouts than traditional indemnity-based insurance, as claims are based on objective data rather than individual assessments.

Various leading agencies provide parametric insurance within crop insurance, demonstrating a shift toward efficient and data-driven risk management strategies in agricultural sectors. For example,

The Agriculture Insurance Company of India Limited (AIC), which serves as the primary executor of the government’s key Crop Insurance Scheme, extended its services to include livestock insurance products, including Saral Krishi Bima and Sampoorna Pasudhan Kavach. Saral Krishi Bima stands out as a distinctive and all-encompassing parametric insurance solution crafted to safeguard farmers against financial setbacks resulting from adverse weather conditions. It operates based on predefined proxy weather parameters, such as temperature, rainfall, and relative humidity. This insurance product aims to protect cattle farmers from financial losses resulting from decreased milk production due to rising temperatures during the summer time. Thus, the rise of parametric insurance, with its ability to provide swift payouts based on objective data, marks a significant shift toward efficient risk management in agriculture.

3. Transforming Crop Insurance with Data Analytics and AI Integration

Innovations in data analytics and artificial intelligence (AI) are revolutionizing the landscape of crop insurance by harnessing large datasets encompassing weather patterns, soil health, historical crop yields, and market trends. This analysis facilitates the development of precise risk models, pricing strategies, and tailored insurance solutions tailored to specific crops and regions.

Aerobotics, a pioneering insurance agency, unveiled Aerobotics Crop Insurance Services. These services take an unprecedented approach to insuring perennial crops. By leveraging artificial intelligence, the company is set to deliver highly accurate crop insurance plans, a groundbreaking advancement in the industry.

Unlike traditional methods reliant on growers’ record-keeping or approximations, Aerobotics’ innovative agency utilizes high-resolution drone imagery processed by proprietary agronomic algorithms. This enables growers to obtain exceptional accuracy regarding their insurable acres, empowering them to select the optimal coverage level for their operations.

4. Strengthening Crop Insurance: Public-Private Partnerships in Action

Governments, insurers, reinsurers, and international organizations are increasingly collaborating to improve the accessibility and affordability of crop insurance, particularly in developing nations. Diverse stakeholders pool their resources and expertise through public-private partnerships to develop and implement effective risk management solutions. In the Philippines, the launch of the first public-private partnership on crop insurance, supported by the Asian Development Bank, has the potential to transform the country’s agricultural insurance sector. The Philippine Crop Insurance Corporation and private insurer CARD Pioneer Microinsurance, Inc. are joining forces to provide insurance coverage for selected high-value crops, such as coconut, coffee, cacao, banana, sugarcane, and pineapple. This shows the power of collaboration in advancing agricultural resilience.

WHICH REGION IS LEADING THE CROP INSURANCE INDUSTRY?

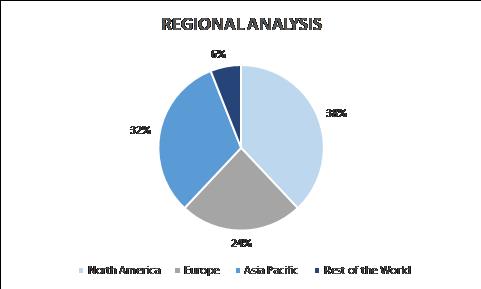

The agriculture sector in North America, particularly in the central lowlands encompassing Canada and the U.S., is highly productive despite only 12% of the total surface being suitable for agriculture. Monoculture, a prevalent farming practice, poses risks due to nutrient depletion and susceptibility to crop diseases, especially in tropical and subtropical regions. To mitigate such risks, governments in North America consistently support agricultural production through subsidies and insurance programs. For example, AgriSompo North America offers top-tier agricultural risk solutions through a nationwide network of agents. Additionally, severe drought conditions in regions such as the U.S. and Canada further drive the demand for insurance, underscoring its importance in ensuring the stability and resilience of the agri-food sector in the region.

Source: Next Move Strategy Consulting

The governments within this region consistently support production through subsidies and agricultural insurance initiatives. These programs enhance productivity and competitiveness within the North American agri-food sector while addressing uncertainties inherent in agricultural activities. For instance, AgriSompo North America delivers top-tier agricultural risk management solutions with the help of its network of independent agents nationwide.

Furthermore, the Asia-Pacific region stands as the world’s foremost agricultural producer, with the industry serving as a cornerstone of the regional economy. It covers more than half of the region’s land area and employs one-fifth of its workforce. Notably, China and India lead in food production within the Asia-Pacific region, benefiting from extensive arable land and sizable populations that drive the demand for agricultural goods.

Despite notable increases in production, Asia-Pacific still lags behind other regions in terms of yield, due to factors, such as resource depletion, declining soil quality, logistical challenges, and inefficient farming practices and land utilization. Additionally, adverse climatic conditions including floods, typhoons, and heavy rainfall—particularly prevalent in countries such as China, India, and Japan—contribute to poor harvests and financial hardships for farmers. Consequently, various nations in the region have implemented crop insurance programs to bolster farmer support and embraced innovative techniques and technologies to bolster crop yields.

Moreover, insurers offer a range of pilot insurance schemes to foster sectoral growth and provide compensation to consumers for potential losses. These factors collectively drive the high demand for crop insurance among farmers in Asia-Pacific nations.

CONCLUSION

As the agricultural market undergoes continual transformation, propelled by shifts in climate patterns, market dynamics, and technological progress, crop insurance emerges as a crucial support for farmers worldwide. As the agricultural industry continues to evolve in response to global challenges and opportunities, crop insurance stands as a beacon of stability and progress. It is guided by the principles of technological innovation, financial inclusivity, and collective action. By embracing the transformative potential of technology, embracing innovative risk-sharing models, and nurturing partnerships that transcend borders and disciplines, we can unlock new pathways toward resilience, sustainability, and prosperity in the agricultural sector. This would ensure a brighter future for farmers and communities worldwide.

ABOUT THE AUTHOR

Sikha Haritwal is a researcher with more than 3 years of experience. She has been keeping a close eye on several industry verticals, including Banking, Financial Services, and Insurance (BFSI), personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography. The author can be reached at [email protected].